How to Build Wealth | Fixed Rate Mortgage

Whether interest rates are in the 3’s or the 6’s the fixed rate mortgage is one of the most powerful wealth builders in the universe. By locking in a stable interest rate, a fixed rate mortgage can be used as a tool to build wealth over time. Regular mortgage payments, combined with an appreciating property value, can help homeowners build equity, or ownership in their home, which can serve as a valuable asset and source of long-term financial security. Additionally, the predictable monthly payments of a fixed rate mortgage can allow for budgeting and financial planning.

How the Fixed Rate Mortgage Builds Wealth

Number one is appreciation. It's not just appreciation, but it's a leveraged appreciation. For example, if you put 20% down on a home, you are leveraged 5x. That means if you get 5% appreciation, you actually don't have 5% appreciation on your money, you multiply that by the 5x factor which would be a 25% return.

Another example is if you're 10% down, that is 10x leverage and so 5% down then turns into a 50% return on your investment. That's the amazing thing with a fixed rate mortgage, the bank is paying for a majority of the capital yet they're not benefiting from any of that appreciation. What other business endeavor is out there that allows you to take advantage of 100% when you're not putting down all of the money?

The second key is the principal savings account. When you make a mortgage payment, a portion of that payment goes toward the principal to pay down your loan. If you have a 15-year loan, it pays off in 15 years. If you have a 30-year loan, it pays off in 30 years. A portion of that payment goes to, kind of like, a forced savings account that you get to benefit from later when either you sell the home or you refinance the home.

The third benefit is tax savings. Check with your CPA and check with your accountant because everybody's taxes are different, but in general, you're able to deduct a portion of your mortgage payment towards your taxes. That will also likely decrease the amount of taxes paid and give you a refund. You can even file what's called a W-4 to lower the amount of taxes that you pay each month to factor this in to increase your cash flow each month.

The reason that Uncle Sam does this is they want to partner with you on your mortgage. Why are they doing that? Because of our debt in this country, they can only increase their debt load when you take out a mortgage. The government is actually incentivizing you to take out this mortgage because they have debt and they need your debt to be able to finance the over-government spending that they're doing.

Example | Build Wealth with the Fixed Rate Mortgage vs. Renting

Let's go over a quick example of how the fixed rate mortgage helps you build wealth instead of renting. Quick disclaimer, there are a lot of assumptions baked into this example. Your situation may be different, but this example will help you start to understand the concepts and how this can apply to your situation.

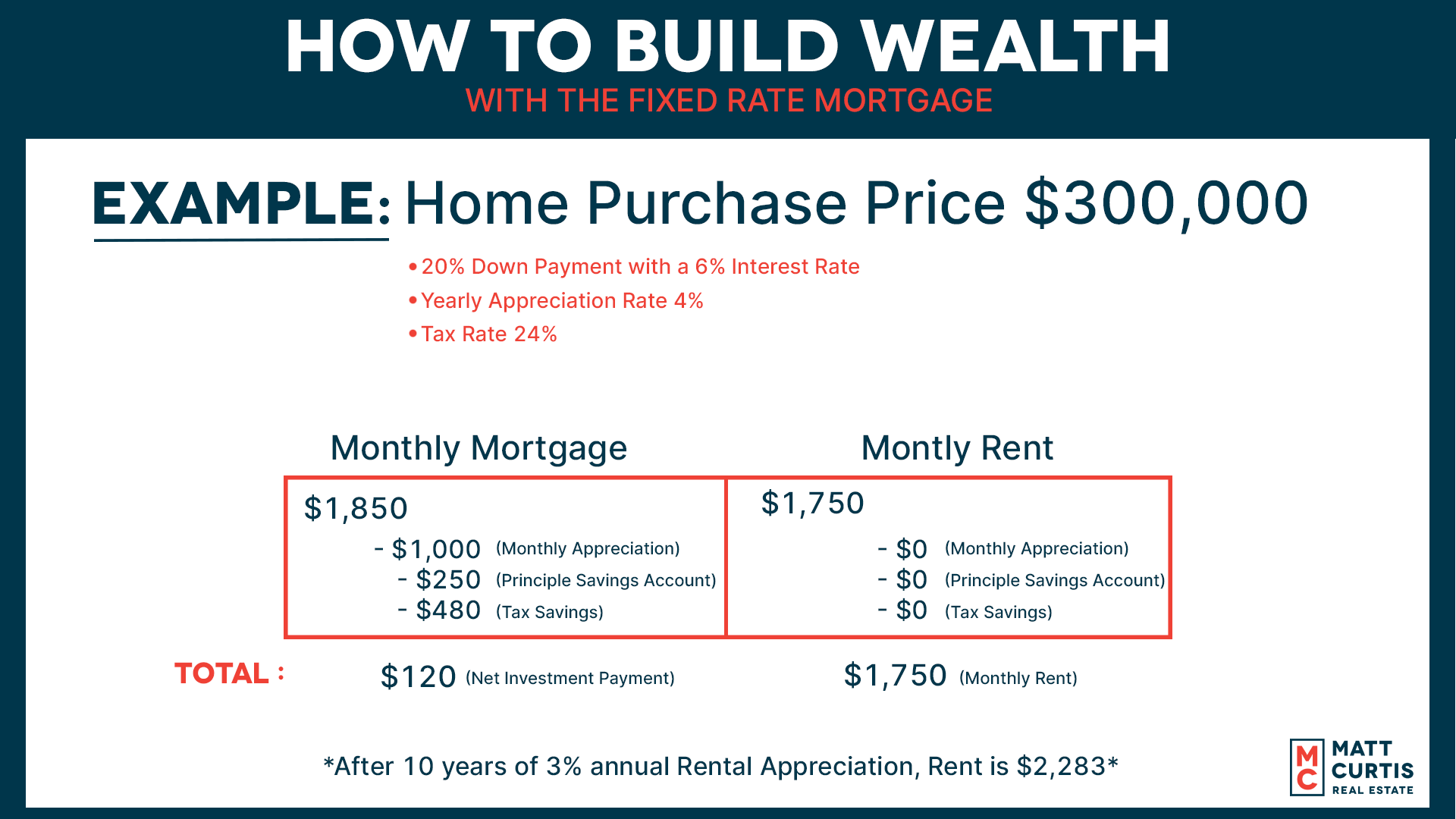

Let’s say you buy a house for $300,000 and the mortgage payment is $1,850 a month while to rent that same home it’s $1,750 per month. I would argue that you probably can't get apples to apples because typically buying a home is going to be more well-maintained than renting a home but let's say you could do the same thing. On the surface it looks cheaper to rent but when we apply these three principles, we'll see that it's different.

First, let's look at appreciation. Historical appreciation rates are between 3% to 5% so let's take somewhere in the middle at 4%. On a $300,000 home, a 4% appreciation is an annualized appreciation of $12,000 per year. If you divide that by 12 months in a year, you get an average of $1,000 of appreciation each and every month.

If your mortgage payment was $1,850, you subtract the $1,000 appreciation that you're going to be able to benefit from in the future when you sell your home or you refinance which takes your net payment down to $850 at this point.

The second thing to look at is your principal reduction. As we mentioned, a portion of your mortgage goes towards principal reduction. It starts out small and grows over time, especially toward the end of your 15-year or 30-year mortgage. So in this example, let's assume that $250 of that payment is going toward principal reduction. We started with a $1,850 mortgage and reduced it by $1,000 for appreciation, so we get to $850 but with another $250 off for your principal reduction, we're down to $600 for your net investment payment on this home.

The third principle is your tax estimated savings. A lot of assumptions go into this depending on what your federal tax rate is and your Alabama state tax rate is, but assuming 24% on those numbers, we're going to get about a $480 per month tax savings.

There are two ways to benefit from this. You can benefit from a tax refund at the end of the year or you can refile your W-4 so that you claim more dependents and keep more of your take-home pay each and every month to increase your cash flow. This one is different than the first two. The first two are appreciation and your principal reduction which are benefits that you're going to get as you sell your home or as your refinance. Your taxes are going to be something that you benefit from when you collect your refund check or as you lower your taxes on a monthly basis. With that estimate of $480 savings, we're now down to $120 per month in your net investment payment in this home versus $1,750 a month in renting.

Not only are you at $1,750 a month renting versus $120 a month in your net investment payment and your net savings, but as you assume appreciation on that rental value over time that's going to add up to $2,283 a month. We’re using a 3% rental appreciation rate, which is pretty conservative for rental appreciation. You've got a $2,283 payment versus a net investment payment of about $120 on your mortgage after ten years.

Matt’s Advice

If you rent for $1,750 per month that potentially increases to about $2,283 per month over the next ten years and you contrast that to your net investment payment on your mortgage of only about $120 per month, is there any doubt on why there's a net worth difference between homeowners and renters? It's about a 40x difference, about $5,500 versus over $250,000 for homeowners.

So if you'd like to become a homeowner this year and increase your net worth. Send us an email at moving@mattcurtisrealestate.com or contact us here, we look forward to helping you achieve your real estate dreams this year!

Posted by Matt Curtis on

.96.jpeg)

Send Us A Message