How Does Homestead Exemption Work in Madison County?

Homestead Exemption is a “tax break” offered by the state of Alabama to property owners. Property owners are entitled to homestead exemption if they own a single-family residence and occupy it as their primary residence. In Alabama, owners must live in the residence prior to October 1st of the tax year of which the property owner is applying.

Receiving a homestead exemption is important, because it can greatly reduce your tax liability. The deadline to apply is December 31st of the tax year in which you would like to receive the homestead exemption.

To apply for a homestead exemption, you need to bring proper documentation to your local courthouse and apply for the tax exemption.

Proper documentation includes:

-

Copy of Deed with correct address, legal description, and names.

-

Address of your driver’s license must match the property address.

-

If you address on your license does not match, you can file for a second home status that gives you a 10% rate until you can complete the homestead exemption

Filing for a homestead exemption is important because it lowers your tax rate significantly. This tax rate is for owners living in the home only and occupying it as their primary residence. Owners of investment properties are subject to a higher tax rate.

After you apply for the homestead exemption, you will receive a letter in the mail confirming that you have received the exemption. You only need to apply once after moving into the residence to receive homestead, it is not a yearly requirement.

Moving into Alabama from Out of State

If you are coming from out of state and moving into the state of Alabama, out of state licenses must transfer at one of five Department of Public Safety offices in either Huntsville, Scottsboro, Guntersville, Decatur, or Athens. Satellite offices cannot change over an out of state license. If you are wanting to change your out of state license and apply for homestead at the same time, you need to make sure you have all licensing requirements with you, in addition to the deed of the property and requirements for homestead.

After receiving your new Alabama license, you can use your temporary Alabama license to then apply for homestead.

The closing team at Matt Curtis Real Estate, Inc can walk you through any questions you have about Homestead Exemption when you close on your new home.

Research before you buy

You can find information on tax rates in each county online at their respective tax assessor’s online website:

Madison County, Alabama: https://www.deltacomputersystems.com/al/al47/index_assessor.html

Limestone County, Alabama: https://www.limestonerevenue.net/CAPortal_MainPage.aspx

Morgan County, Alabama: https://www.morgancountyrevenue.com/property-search

You will want to check prospective properties online before putting in an offer on them to check their homestead exemption status. Properties that do not currently have a homestead exemption are subject to a higher tax rate until the homestead exemption is filed, and this higher tax rate would have the potential to affect the amount you are eligible to finance on a home. Since a higher tax rate would create a higher monthly payment. Although this rate could be changed after you purchased the property, if the amount made a great enough difference in your financing options, it could create an issue getting financing on the home.

To search on the property tax websites above, you’ll need to know either a property address or a parcel ID. Look for an exemption code of “H1” on the information page for the property. This exemption code indicates that a homestead exemption is already in place on the home and you will just need to file after purchasing the home to keep the homestead exemption.

Madison County has a great online tool you can use to estimate approximate tax rates and to see how they could affect your monthly payment. The took breaks down tax rates for each potential city. You can use this form online at: https://www.madisoncountyal.gov/departments/tax-collector/frequently-asked-questions

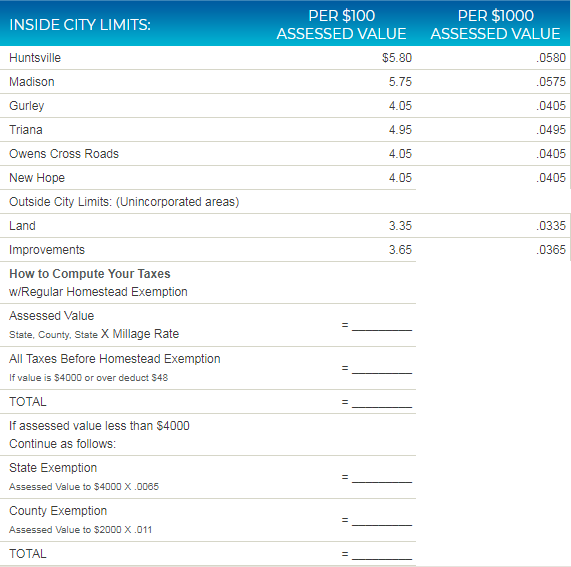

Below is a sample form that you can fill out at the Madison County government website. Current tax rates as of the time of this article are:

Madison County tax rate form available at: https://www.madisoncountyal.gov/departments/tax-collector/frequently-asked-questions

A Matt Curtis Real Estate agent can assist you in navigating all of the questions that come up during the home buying process.

Call 256-333-MOVE to be connected with a MCRE Agent today!

v

Posted by Matt Curtis on

Send Us A Message